The number of Fallen Angels – companies whose credit quality has shifted from investment-grade to high-yield or “junk” status – continues to increase, yet each update brings a smaller total number than the last.

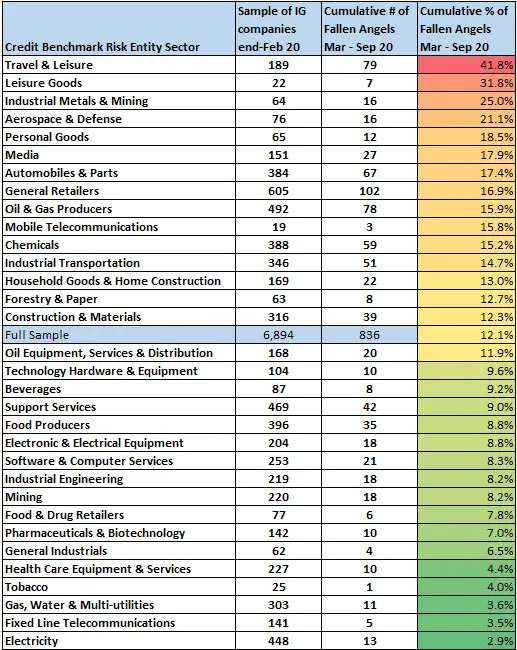

Each month, Credit Benchmark tracks a global sample of corporations across all sectors to gauge the percentage of firms at risk of losing their investment-grade status. This month’s report captures consensus credit data for 6,894 companies that were classed as Investment-grade as at end-Feb 2020 and finds that 836 (about 12%) are now classified as High Yield, according to the internal risk views of over 40 leading global financial institutions. This is an increase of 64, which is lower than last update’s increase of 93. Of the 32 sectors examined, 15 have a higher percentage of Fallen Angels than the average for the full sample.

Once again, Travel & Leisure is in the pole position with 42% of firms classified as Fallen Angels, up slightly from the prior month. Following that are Leisure Goods at 32% and Metals & Mining at 25%, each unchanged from the prior month.

Also unchanged from the prior update are Aerospace and Defense at 21% and Personal Goods at 19%.

Drops in credit quality can be seen in Media, now at 18%; General Retailers, now at 17%; Oil & Gas Producers, now at 16%; and Chemicals, now at 15%.

Deterioration can also be seen in Construction & Materials, now at 12%; Support Services and Electronic & Electrical Equipment, each now at 9%; and in General Industrials, now at 7%.

The best-performing sectors – those with the lowest percentage of Fallen Angels – are Fixed Line Telecommunications at 4% and Gas, Water, & Multi-utilities at 3%, each at 4%, and Electricity at 3%.

As previously noted, widely cited research suggests up to one third of all corporate bonds with the BBB designation might shift to “junk” status, despite a possible reluctant on the part of agencies to downgrade. Consensus credit data from Credit Benchmark supports this thesis.

The credit sample examined above is based on issuers instead of issues and includes all investment-grade companies, not just BBB. Still, the growing Fallen Angel rates shown here that covers the first six months of the COVID crisis – indicate that the shift for some sectors by the end of 2020 may be yet higher than has so far been suggested. This is true even if the pace of growth is slowing.